This House believes that now is the time to migrate to America

7:01 am on Wed 25th Feb by Anish

Brewster Debate 2009- Fitzwilliam College, Cambridge

Honourable Chair, Ladies and Gentlemen,

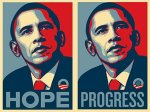

I think the most appropriate place for me to start is with the words of Barack Obama himself when talking about the current state of the US economy on February 5th 2009, and I quote, "this country may not ever recover". They say that Nero fiddled whilst Rome burned...(pause 1 second), no doubt history will say the same about Obama.

A President who was elected on the grounds of hope and change deploys rhetoric and instils fear in an attempt to pass a stimulus package of $825 billion dollars that the Levy economics institute with Director Joseph Stiglitz (a Nobel laureate in Economics and an honorary fellow of this college) claims to be 1.1 trillion short of what is needed to reverse the economic contraction along with other policies to restructure banks. The stimulus is a drop in the ocean; a tiny fiddle with the levers of power when a full scale turn is required.

This evening I will focus on the economic reasons which suggest this is the worst time to be migrating to the United States. I do not disagree that Britain is also in a dire financial turmoil, but I base my debate on the fact that there are no considerable pull factors that make the US more attractive and hence there is no pressing reason to migrate there. To back this up, I touch on why some of the points made by the IMF with regard to the UK may be somewhat exaggerated.

I also make a vital point, which is that if we assume ceterus paribus (which I as an economist cannot resist!) that is to say that all things equal, then in fact the status quo of staying in Britain would be the best option. I shall also hone in on the micro-foundations of the economy and how a single individual migrating to the US may be affected over a short to medium term horizon. Looking any further would be useless in the words of John Maynard Keynes (another Cambridge economist), "for in the long run we are all dead".

1) The proposition will claim that the strong economic stimulus package will somehow make the US economy a better place for an individual looking for a job, or trying to buy a new house. I say this is a flawed logic. The stimulus package is a moderate plan that provides far too little, far too late. First, too much of the boost to demand is back-loaded to 2010 and beyond. The compromise bill is bloated with spending determined more by democrat lawmakers' pet projects than by the efficiency with which the economy will be boosted. Even at critical junctures then, the US congress fails to avoid pork barrel spending. Furthermore it contains "Buy American" clauses that, even in their watered-down version, send the wrong signal to trading partners in the modern era of globalisation. Protectionism prolonged the Great Depression; and if resorted to again will create the second Great Depression.

The fiscal stimulus, indispensable as it is, cannot create a lasting economic recovery in a country with a broken financial system. The lesson of big banking busts, such as Japan's in the 1990s, is that debt-laden balance sheets must be restructured and troubled banks fixed before real recoveries can take off. Put simply, you cannot put more water into a broken bucket and expect the bucket to remain full.

Moreover, while Tim Geithner recognises that there is a need for a comprehensive policy response, his to-do list was woefully inadequate on some of the most pressing issues, such as nationalising insolvent banks, dealing with toxic assets and failing mortgages. He promised to "stress test" the big banks but offered few details about the terms of public-cash infusions or whether they would, eventually, imply government control. This uncertainty is not only unwelcome to investors, but also further corrodes the ability of institutions to allow capital to flow into equities once again. Banks' balance sheets are clogged with toxic junk precisely because they are unwilling to sell the stuff at prices hedge funds and other private investors are willing to pay. Vagueness, in turn, led to incoherence. How can you stress-test banks if you do not know how their troubled assets will be dealt with at what price? The US, to put it mildly, is running about like a headless chicken.

2) Ladies and Gentlemen, as i claimed earlier, the UK economy is no beacon of prosperity. However, the push factors may not be as high as we think. Britain has plunged rapidly into recession but it shall pull out more steeply too. One reason to think so is that sterling has fallen sharply, its trade-weighted value down by a quarter since January 2007. Though some see it as a national misfortune, the sterling's slide will help to cushion the economy this year and pave the way for eventual recovery. While global trade is in free fall, exports will drop too, despite the weaker pound. But profit margins on foreign sales will improve and, with imports dearer, domestic producers will grab a bigger share of the home market.

Moreover, after being squeezed last year by rising fuel and food prices, households will benefit from the sharp fall in inflation and maybe even deflation. Spending will be boosted by the unprecedented cuts in interest rates since last autumn. And consumers will gain from the temporary reduction in value-added tax, worth about 12.5 billion over 3 months. House prices will fall to more realistic levels that first time buyers will not be stretched to afford (thus preventing a repeat of 100% mortgages and another sub prime bubble).

3) In late January the pound fell to a 25 year low against the US dollar trading at just $1.36. What does this mean for the individual thinking of migrating to the US? This means that he/she will have to presumably sell their house on a housing market in tatters, will then have to convert that into US dollars at the worst possible exchange rate in 25 years and will then have to find a job in the worst job market in the US since 1974. Do you seriously think that this is an economically adroit move? I think not.

At a time when the emerging markets are still shining through the fog of recession, a sentinel stands quietly rusting in the corner. Brand America, once the byword for integrity, freedom and hope, has been tarnished by attack after attack on her foundations. America Inc has fallen into disrepair and ignominy. Her glorious past cannot compensate her murky present. Her leader's words form a ghostly echo of a glorious era, now devoid of substance. Her reputation stands in tatters and shreds. Through the incompetence and inaction of her leaders, through the greed of her citizens, we know her grave is being dug. We know that the stars and stripes that did flutter once so proudly so valiantly shall now avail of their final destiny : to drape the coffin of prosperity in America

Honourable Chair, Ladies and Gentlemen,

I think the most appropriate place for me to start is with the words of Barack Obama himself when talking about the current state of the US economy on February 5th 2009, and I quote, "this country may not ever recover". They say that Nero fiddled whilst Rome burned...(pause 1 second), no doubt history will say the same about Obama.

A President who was elected on the grounds of hope and change deploys rhetoric and instils fear in an attempt to pass a stimulus package of $825 billion dollars that the Levy economics institute with Director Joseph Stiglitz (a Nobel laureate in Economics and an honorary fellow of this college) claims to be 1.1 trillion short of what is needed to reverse the economic contraction along with other policies to restructure banks. The stimulus is a drop in the ocean; a tiny fiddle with the levers of power when a full scale turn is required.

This evening I will focus on the economic reasons which suggest this is the worst time to be migrating to the United States. I do not disagree that Britain is also in a dire financial turmoil, but I base my debate on the fact that there are no considerable pull factors that make the US more attractive and hence there is no pressing reason to migrate there. To back this up, I touch on why some of the points made by the IMF with regard to the UK may be somewhat exaggerated.

I also make a vital point, which is that if we assume ceterus paribus (which I as an economist cannot resist!) that is to say that all things equal, then in fact the status quo of staying in Britain would be the best option. I shall also hone in on the micro-foundations of the economy and how a single individual migrating to the US may be affected over a short to medium term horizon. Looking any further would be useless in the words of John Maynard Keynes (another Cambridge economist), "for in the long run we are all dead".

1) The proposition will claim that the strong economic stimulus package will somehow make the US economy a better place for an individual looking for a job, or trying to buy a new house. I say this is a flawed logic. The stimulus package is a moderate plan that provides far too little, far too late. First, too much of the boost to demand is back-loaded to 2010 and beyond. The compromise bill is bloated with spending determined more by democrat lawmakers' pet projects than by the efficiency with which the economy will be boosted. Even at critical junctures then, the US congress fails to avoid pork barrel spending. Furthermore it contains "Buy American" clauses that, even in their watered-down version, send the wrong signal to trading partners in the modern era of globalisation. Protectionism prolonged the Great Depression; and if resorted to again will create the second Great Depression.

The fiscal stimulus, indispensable as it is, cannot create a lasting economic recovery in a country with a broken financial system. The lesson of big banking busts, such as Japan's in the 1990s, is that debt-laden balance sheets must be restructured and troubled banks fixed before real recoveries can take off. Put simply, you cannot put more water into a broken bucket and expect the bucket to remain full.

Moreover, while Tim Geithner recognises that there is a need for a comprehensive policy response, his to-do list was woefully inadequate on some of the most pressing issues, such as nationalising insolvent banks, dealing with toxic assets and failing mortgages. He promised to "stress test" the big banks but offered few details about the terms of public-cash infusions or whether they would, eventually, imply government control. This uncertainty is not only unwelcome to investors, but also further corrodes the ability of institutions to allow capital to flow into equities once again. Banks' balance sheets are clogged with toxic junk precisely because they are unwilling to sell the stuff at prices hedge funds and other private investors are willing to pay. Vagueness, in turn, led to incoherence. How can you stress-test banks if you do not know how their troubled assets will be dealt with at what price? The US, to put it mildly, is running about like a headless chicken.

2) Ladies and Gentlemen, as i claimed earlier, the UK economy is no beacon of prosperity. However, the push factors may not be as high as we think. Britain has plunged rapidly into recession but it shall pull out more steeply too. One reason to think so is that sterling has fallen sharply, its trade-weighted value down by a quarter since January 2007. Though some see it as a national misfortune, the sterling's slide will help to cushion the economy this year and pave the way for eventual recovery. While global trade is in free fall, exports will drop too, despite the weaker pound. But profit margins on foreign sales will improve and, with imports dearer, domestic producers will grab a bigger share of the home market.

Moreover, after being squeezed last year by rising fuel and food prices, households will benefit from the sharp fall in inflation and maybe even deflation. Spending will be boosted by the unprecedented cuts in interest rates since last autumn. And consumers will gain from the temporary reduction in value-added tax, worth about 12.5 billion over 3 months. House prices will fall to more realistic levels that first time buyers will not be stretched to afford (thus preventing a repeat of 100% mortgages and another sub prime bubble).

3) In late January the pound fell to a 25 year low against the US dollar trading at just $1.36. What does this mean for the individual thinking of migrating to the US? This means that he/she will have to presumably sell their house on a housing market in tatters, will then have to convert that into US dollars at the worst possible exchange rate in 25 years and will then have to find a job in the worst job market in the US since 1974. Do you seriously think that this is an economically adroit move? I think not.

At a time when the emerging markets are still shining through the fog of recession, a sentinel stands quietly rusting in the corner. Brand America, once the byword for integrity, freedom and hope, has been tarnished by attack after attack on her foundations. America Inc has fallen into disrepair and ignominy. Her glorious past cannot compensate her murky present. Her leader's words form a ghostly echo of a glorious era, now devoid of substance. Her reputation stands in tatters and shreds. Through the incompetence and inaction of her leaders, through the greed of her citizens, we know her grave is being dug. We know that the stars and stripes that did flutter once so proudly so valiantly shall now avail of their final destiny : to drape the coffin of prosperity in America

Anon. wrote at 8:14 am on Wed 25th Feb -

tl;dr

Moosra wrote at 1:41 am on Thu 26th Feb -

What a high ending. Whoever wrote that must be a genius!

Comments have been disabled. You can probably comment on this post on Geek On A Bicycle.

"The end move in politics is always to pick up a gun." - R. Buckminster Fuller